What Is The Right Time To Redeem Money From Bluechip Mutual Fund If The Market Value Is Good

SBI Bluechip Fund-Growth

Scheme Rating

Fund Central Highlights

i. The Current Net Asset Value of the SBI Bluechip Fund every bit of 25 May 2022 is Rs 55.5394 for Growth selection of its Regular plan.

2. Its trailing returns over different time periods are: eight.53% (1yr), 13.71% (3yr), 10.11% (5yr) and eleven.25% (since launch). Whereas, Category returns for the same time duration are: 9.48% (1yr), xiii.43% (3yr) and 11.21% (5yr).

Show Less +

Things you should consider

Fund NAV Range

Nugget Allotment

Loading...

Electric current vs Stated Allotment

Investment Growth

Loading...

Other MFs

Indices

ETFs

Stocks

NPS Schemes

Enter investment corporeality:

Rs. 500

Rs. 1000

Rs. 5000

OR

Just i asset can exist added for purpose of comparing

Basic Details

| Fund House | SBI Mutual Fund |

| Launch Date | 14-Feb-2006 |

| Return Since Launch | 11.1% |

| Benchmark | S&P BSE 100 Alphabetize |

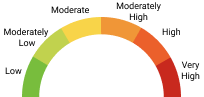

| Riskometer | Very High |

| Type | Open-ended |

| Assets | 31,442.75 Cr (As on 31-Mar-2022) |

| Exense | 1.76% (Every bit on thirty-Apr-2022) |

| Risk Grade | Average |

| Return Grade | Average |

| Turnover | 6.0% |

Investment Details

| Minimum Investment (₹) | 5,000.00 |

| Minimum Addl Investment (₹) | 1,000.00 |

| Minimum SIP Investment (₹) | 500.00 |

| Minimum Withdrawal (₹) | 500.00 |

| Exit Load | Leave load of one% if redeemed within 1 year |

Existing investor

Evaluate your investment functioning

OR

OR

No data available for the selected time menstruation / dates. Please cull a different date.

Tiptop v Peer Comparison

Add Common Funds to your Portfolio

Cull Transaction Blazon

Your transactions have been added

My Transactions

Login to view your Mutual Fund Transactions

SBI Bluechip Fund

SBI Bluechip Fund is an open-ended disinterestedness mutual fund scheme that follows the large cap nugget allotment investment strategy. The fund currently manages assets worth Rs 21,585 crore as on July 31, 2019.

The investment objective of the fund is to provide investors with opportunities for long-term growth in capital through an active management of investments in a diversified basket of big cap equity, according to SBI Mutual Fund.

"SBI Bluechip Fund follows a alloy of growth and value style of investing with a combination of acme downwards and bottom-up investment strategy for stock selection across sectors. Besides, the fund invests a minimum of 80% in large cap stocks which are well established companies with practiced brand disinterestedness and are possibly market place leaders in their industries. Apart from that, the fund has the flexibility to invest up to 20% in equities other than large caps or debt and/or coin market instruments, according to SBI Mutual Fund.

Minimum investment required is Rs 5000, and minimum additional investment is Rs 1,000. Minimum SIP investment is Rs 500.

SBI Bluechip Fund is managed past Sohini Andani. She has been managing the fund since September, 2010. Co-ordinate to SBI Common Fund, the suggested investment horizon for investing in SBI Bluechip Fund is three years and to a higher place. The scheme is suitable for investors with a moderate loftier risk tolerance.

Near Fund

1. SBI Bluechip Fund is Open up-concluded Large Cap Equity scheme which belongs to SBI Mutual Fund House.

ii. The fund was launched on Feb xiv, 2006.

Investment objective & Benchmark

1. The investment objective of the fund is that " The scheme seeks to provide investors with opportunities for long-term growth in capital through an active management of investments in a diversified basket of big cap equity stocks (as specified by SEBI/AMFI from time to time). "

2. It is benchmarked against S&P BSE 100 Index.

Asset Resource allotment & Portfolio Composition

i. The asset allocation of the fund comprises around 96.5% in equities, 0.0% in debts and 3.5% in cash & greenbacks equivalents.

2. While the top 10 disinterestedness holdings constitute around 46.58% of the assets, the peak three sectors establish around 48.19% of the avails.

3. The fund largely follows a Growth oriented style of investing and invests beyond market capitalisations - effectually 86.77% in giant & large cap companies, 13.23% in mid cap and 0.0% in small cap companies.

Tax Implications

1. Gains are taxed at a rate of 15% (Brusque-term Uppercase Gain Tax - STCG) if units are redeemed within 1 year of investment.

two. For units redeemed after ane year of investment, gains of upto Rs. one lakh accruing from those units in a financial year shall exist exempted from taxation.

iii. Gains of more than Rs. i lakh will be taxed at a charge per unit of ten% (Long-term Capital letter Gain Tax - LTCG).

4. For Dividend Distribution Tax, the dividend income from this fund will go added to the income of an investor and taxed according to his/her respective tax slabs.

five. Also, for dividend income in excess of Rs five,000 in a financial twelvemonth; the fund house shall deduct a TDS of ten% on such income.

Frequently Asked Questions (FAQs)

Q: Is it safe to invest in SBI Bluechip Fund?

A: Equally per SEBI's latest guidelines to summate risk grades, investment in the SBI Bluechip Fund comes under Very High take a chance category.

Q: What is the category of SBI Bluechip Fund?

A: SBI Bluechip Fund belongs to the Equity: Big Cap category of funds.

Q: How Long should I Invest in SBI Bluechip Fund?

A: The suggested investment horizon of investing into SBI Bluechip Fund is >3 years. The suggested investment horizon is the minimum time required for holding investments in the fund to reduce its downside adventure and ensure that the returns become more anticipated.

Q: Who manages the SBI Bluechip Fund?

A: The SBI Bluechip Fund is managed by Sohini Andani (Since Sep 16, 2010).

Source: https://economictimes.indiatimes.com/sbi-bluechip-fund/mffactsheet/schemeid-3083.cms

Posted by: judkinswrue1972.blogspot.com

0 Response to "What Is The Right Time To Redeem Money From Bluechip Mutual Fund If The Market Value Is Good"

Post a Comment